Medicare Enrollment Periods

Key Points

A Medicare Enrollment Period is a specific window of time when you’re allowed to enroll in Medicare or make changes to your Medicare coverage.

Your Initial Enrollment Period (IEP) is the first opportunity to sign up for Medicare Parts A and B. Missing this window without having other creditable coverage can result in late enrollment penalties.

There are also additional enrollment periods dedicated to Medicare Advantage (Part C), Part D prescription drug plans, and Medigap supplemental insurance. Each has its own timing and rules.

We'll Find The Right Plan for YOU for FREE

We understand Medicare, so you don't have to

Guide To Enrollment Periods

IEP - Initial Enrollment Period

The Initial Enrollment Period (IEP) is a 7-month window that gives you the opportunity to enroll in Medicare Parts A and B when you turn 65. It includes:

• 3 months before your 65th birthday

• The month of your 65th birthday

• 3 months after your birthday month

Enrolling during the three months after your birthday may lead to a delay in coverage.

This same 7-month window also applies if you wish to enroll in a Medicare Advantage (Part C) or Part D prescription drug plan for the first time.

AEP - Annual Election Period

The Annual Election Period (AEP) commences on October 15th and concludes on December 7th annually. During this period, Medicare beneficiaries with existing Part A and Part B coverage can make choices such as enrolling in, changing, or disenrolling from a Part D or Medicare Advantage plan.

GEP - General Enrollment Period

The General Enrollment Period (GEP) is available for individuals who missed their Initial Enrollment Period (IEP) and do not qualify for a Special Enrollment Period.

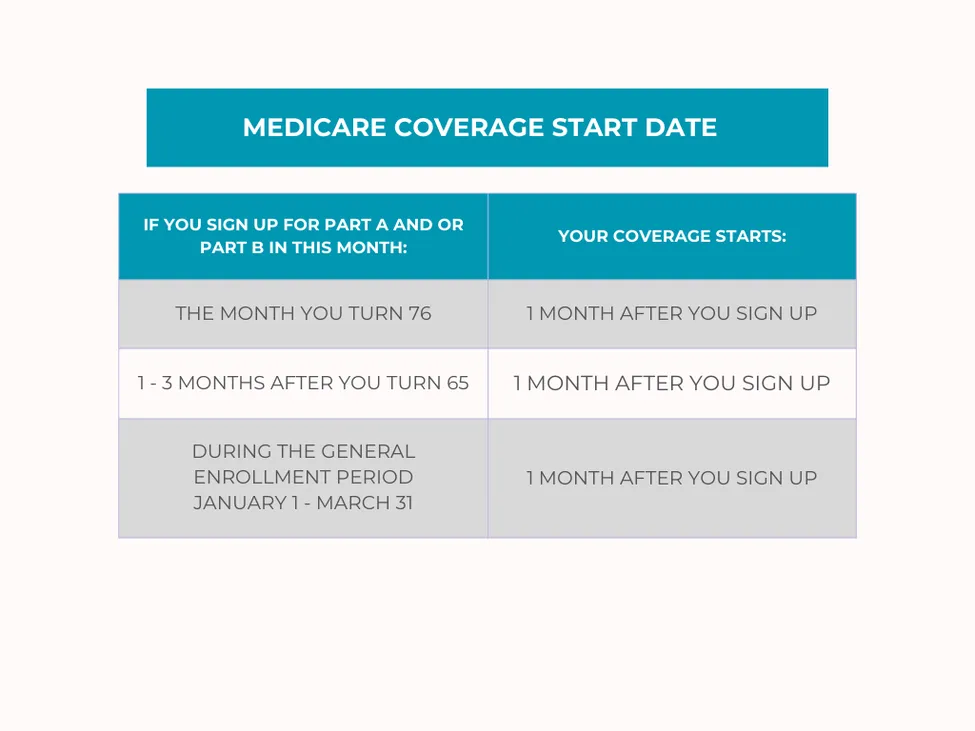

The GEP runs each year from January 1 to March 31, and any enrollment during this time will result in coverage starting on the first day of the month after your application is submitted.

OEP - Open Enrollment Period (Medicare Advantage)

The Medicare Advantage Open Enrollment Period (OEP) is specifically for individuals who are already enrolled in a Medicare Advantage plan and want to make a change.

From January 1 to March 31, you have the option to switch to a different Medicare Advantage plan or disenroll and return to Original Medicare, with the ability to add a Part D prescription drug plan if needed.

SEP - Special Election Period

A Special Enrollment Period (SEP) applies when you experience a qualifying life event. For example, if you delayed Medicare enrollment past age 65 because you had creditable coverage through active employment, you can use a SEP to enroll in Medicare Parts A and B once that coverage ends.

There are also Special Election Periods for Medicare Advantage and Part D prescription drug plans. If you experience a qualifying event, you typically have a 2-month window to enroll in or make changes to one of these plans.

Medigap Open Enrollment Period

When you first enroll in Medicare Part B, you’re granted a 6-month Medigap Open Enrollment Period, which begins on your Part B effective date. During this time, you can enroll in a Medigap (Medicare Supplement) plan without answering health questions or undergoing medical underwriting. If you apply outside of this window and don’t qualify for a Special Enrollment Period, you may be required to answer health questions and could be denied coverage or charged higher premiums.

A 2012 Medicare Rights Center report revealed that approximately 700,000 people incurred a Part B late enrollment penalty in that year alone—highlighting how easy it is to miss crucial deadlines. With multiple enrollment windows—including the Initial Enrollment Period, Medigap Open Enrollment, Annual Election Period (AEP), and Special Enrollment Periods (SEP)—it’s no surprise that navigating Medicare can feel overwhelming.

Additionally, nearly 12% of beneficiaries lacked creditable prescription drug coverage, putting around 6 million people at risk of a Part D late enrollment penalty. These penalties are monthly and permanent, adding up to substantial costs over time.

To avoid gaps in coverage or unnecessary expenses, it’s essential to understand the different Medicare enrollment periods for 2024 and beyond. Staying informed helps ensure you get the right coverage—at the right time and at the right cost.

Initial Enrollment Period (IEP)

As you approach Medicare eligibility, understanding your Initial Enrollment Period (IEP) is essential for ensuring timely and penalty-free coverage.

Your IEP lasts seven months: it begins three months before your 65th birthday month, includes your birthday month, and extends three months after.

For example, if your 65th birthday is May 20th, your IEP would run from February 1 to August 31.

There’s one exception: if your birthday falls on the 1st of the month, your IEP starts one month earlier, and your Medicare coverage will also begin a month early. So if your birthday is April 1st, your IEP begins on December 1st, with coverage starting March 1st.

During this window, you can enroll in Original Medicare (Parts A and B) or choose a Medicare Advantage plan (Part C). Enrolling during your IEP helps you avoid late penalties and ensures your coverage begins on time.

To avoid the Part D late enrollment penalty, you should also enroll in prescription drug coverage during your IEP. This can be either a standalone Part D plan or included within a Medicare Advantage plan that offers drug coverage.

If you opt for Original Medicare, you may want to add extra protection with a Medicare Supplement (Medigap) plan. You’ll use your Medigap Open Enrollment Period, which lasts six months from your Part B effective date.

During this time:

• You cannot be denied any Medigap plan available in your area, regardless of health conditions.

• Insurers cannot charge higher premiums based on your health or medical history.

• Coverage for pre-existing conditions cannot be delayed.

Taking full advantage of these enrollment periods helps you secure the right coverage—at the right cost—without unnecessary delays or penalties.

What occurs if I fail to enroll during my Initial Medicare Enrollment Period?

Failing to enroll in Medicare during your Initial Enrollment Period (IEP) can lead to several costly and long-term consequences—especially if you do not have other creditable coverage (such as employer-sponsored insurance).

Let’s break them down:

Part B Late Enrollment Penalty

If you delay enrolling in Medicare Part B without creditable coverage, you’ll face a lifetime penalty. This penalty adds 10% for every full 12-month period you went without Part B when you were eligible.

• As of 2025, the standard Part B premium is $185.00. A 10% penalty equals an additional $18.50 per month, which you’ll continue to pay for as long as you have Medicare—even if you later switch to a Medicare Advantage plan.

In addition, if you miss your IEP, you may have to wait for the General Enrollment Period (GEP), which runs from January 1 to March 31 each year. In that case, your coverage won’t begin until the first day of the month after you apply, leaving you with a potential gap in Part B coverage.

Part D Late Enrollment Penalty

If you don’t enroll in creditable prescription drug coverage (Part D) during your IEP, you’ll face a monthly penalty added to your Part D premium.

• The penalty is 1% of the national base premium for each month you went without coverage. Based on the 2024 national base premium of $34.70, going without coverage for 12 months would result in an additional $3.96 per month, and this amount can increase as the base premium rises.

Part A Late Enrollment Penalty

If you don’t qualify for premium-free Part A due to insufficient work history and choose not to purchase it during your IEP, you’ll incur a 10% penalty on your premium.

• This penalty lasts for twice the number of years you were eligible but didn’t enroll.

If I miss my Initial Enrollment Period (IEP), when can I enroll in Medicare Advantage or Medicare Part D?

The Annual Election Period (AEP) runs each year from October 15 to December 7 and is designated for making changes to Medicare Part C (Medicare Advantage) and Part D (prescription drug plans).

If you missed your Initial Enrollment Period, the AEP gives you another opportunity to enroll in a plan.

During the AEP, you can:

• Switch from Original Medicare to a Medicare Advantage plan

• Change from one Medicare Advantage plan to another

• Drop Medicare Advantage and return to Original Medicare

• Enroll in, change, or drop a Medicare Part D prescription drug plan

If you now have creditable drug coverage through another source, you may also choose to disenroll from Part D during the AEP without facing a late enrollment penalty

.

The AEP offers valuable flexibility each year to reassess your coverage and make adjustments that better suit your healthcare and prescription needs.

What is the timeframe for the Medicare General Enrollment Period?

If you miss your Initial Enrollment Period (IEP) and do not qualify for a Special Enrollment Period (SEP), you can still enroll in Original Medicare during the General Enrollment Period (GEP).

The GEP runs from January 1 to March 31 each year. If you apply during this window, your Medicare Part B coverage will begin on the first day of the month following your application.

However, it’s important not to rely on the GEP as a backup plan. Enrolling during this period can still result in late enrollment penalties, especially if you went without creditable coverage.

Also, note that the GEP only applies to Original Medicare (Parts A and B). If you’re looking to enroll in a Medicare Advantage (Part C) plan or a Part D prescription drug plan, you’ll need to wait for the Annual Election Period (AEP), which occurs each year from October 15 to December 7.

What occurs if you do not sign up for Medicare Part A at the age of 65?

If you have creditable coverage beyond age 65—such as through an employer—you’ll be eligible for a Special Enrollment Period (SEP) to enroll in Medicare once that coverage ends. However, if you do not have creditable coverage, you’ll need to wait for the General Enrollment Period (GEP) to apply, which may result in delays and potential penalties.

Additionally, if you begin receiving Social Security benefits after age 65 and are not already enrolled in Medicare Part A, you will be automatically enrolled. If you qualify for premium-free Part A, there is no penalty for enrolling late.

Medicare Advantage Open Enrollment Period

The Medicare program provides a timeframe for reconsideration regarding your choice of a Medicare Advantage plan. If you enroll in a Medicare Advantage plan and find it unsatisfactory for any reason, you have the option to disenroll during the new Medicare Open Enrollment Period, which runs from January 1 to March 31.

During this period, you can:

1. Return to Original Medicare and select a Part D drug plan to accompany it.

2. Switch to another Medicare Advantage plan once.

It's important to note that if you decide to return to Original Medicare with the intention of obtaining a Medigap plan, it is not guaranteed. In many situations, you may be required to answer health questions for the Medigap plan, and the carrier is not obligated to accept your application.

Medicare Special Enrollment Period

The Medicare Special Enrollment Period (SEP) lasts eight months and begins either when you or your spouse stop working or when your employer-sponsored group health coverage ends—whichever comes first.

In addition, certain personal circumstances can trigger a Special Election Period (also abbreviated SEP) for Medicare Advantage or Part D prescription drug plans. These situations typically grant you a two-month window to make changes to your coverage.

For example, if you move out of your plan’s service area, you become eligible for a Special Election Period. During this time, you can:

• Switch to a new Medicare Advantage or Part D plan

• Return to Original Medicare without penalty

• In some cases, enroll in a Medigap plan with guaranteed issue rights, meaning no medical underwriting is required (note: this varies by state)

There are many circumstances that may qualify you for a Special Election Period. If your situation isn’t listed here, contact us for personalized guidance on your options.

Creditable Coverage

In numerous instances, individuals who are still employed may be covered by a group plan through their employer or union. This option enables them to postpone enrollment in Part A and/or B. Upon retirement, they can enroll in these parts during a Special Enrollment Period. Medicare acknowledges and credits individuals for having employer group coverage with any sizable employer (20+ employees).

Medigap Open Enrollment Period

As stated earlier, upon enrollment in Medicare Parts A and B, you become eligible for a 6-month Open Enrollment period for Medigap plans. This period begins on your Part B effective date and is a singular election window. You have the option to enroll in any Medigap plan of your choice, without being required to answer health questions.

The crucial point to understand about this enrollment period is that it occurs only once for the majority of individuals. Once it passes, it is gone forever, making it one of the Medicare enrollment periods that you must not overlook.

Key Takeaways

Medicare includes several distinct enrollment periods, which are specific timeframes when you can apply for coverage.

There are three key enrollment periods for enrolling in Medicare Parts A and B. In addition, Medicare Advantage (Part C), Part D prescription drug plans, and Medigap (Medicare Supplement) plans each have their own enrollment windows. These periods allow you to enroll, disenroll, or switch plans at designated times throughout the year.

Tessa Crider Insurance - Get FREE Assistance

If Medicare feels confusing, you don’t have to figure it out alone. Our friendly, knowledgeable agents are here to guide you every step of the way—making the process simple and stress-free.

We start with the basics, helping you understand your Original Medicare coverage. This foundation is key to finding the supplemental plan that fits your needs, especially if you’re new to Medicare.

Once your policy is in place, you’ll have peace of mind knowing we’re just a phone call away whenever you need help or have questions.

Best of all—our services are completely free. Experience the difference of having Tessa Crider Insurance on your side. Call (386) 288-2753 or click the button below to get started: