Applying for Medicare

Key Points

If you’re already receiving Social Security benefits at least four months before the month you turn 65, your Medicare enrollment will happen automatically.

For most people, the Initial Enrollment Period (IEP) is the right time to sign up for Medicare—unless you qualify for a Special Enrollment Period (SEP) due to certain life circumstances.

You can apply for Medicare in one of three ways: online, over the phone, or by visiting your local Social Security office.

We'll Find The Right Plan for YOU for FREE

We understand Medicare, so you don't have to

Applying for Medicare may seem overwhelming at first, but the process is more straightforward than it appears. Each year, we help thousands of individuals navigate Medicare enrollment—so you’re in good hands. Keep reading for a step-by-step guide to getting started.

Eligibility and applications for Medicare Parts A (hospital insurance) and B (outpatient medical insurance) are managed by the Social Security Administration. You can apply in the way that’s most convenient for you—online, by phone, or in person at your local Social Security office.

If you’re nearing Medicare eligibility, you can apply as early as three months before the month of your 65th birthday. Applying early is a smart move, as it ensures you receive your Medicare card before your coverage begins.

This timeframe is known as your Initial Enrollment Period (IEP). During this window, you can enroll in both Part A and Part B. It’s also when you can enroll in Medicare Part D—the optional prescription drug coverage. Since Original Medicare doesn’t include drug benefits, Part D must be purchased separately through a private insurance company. Enrollment in Part D is not done through Social Security because it’s a voluntary program.

In the next sections, we’ll break down the key timing details and deadlines for Medicare enrollment.

When Should I Apply for Medicare?

Medicare enrollment is separate from the process of applying for Social Security income benefits. You become eligible for Medicare at age 65, regardless of whether you’ve started receiving retirement income. U.S. citizens aged 65 and older are entitled to enroll, and certain individuals may qualify earlier due to specific conditions such as a disability, End-Stage Renal Disease (ESRD), or Amyotrophic Lateral Sclerosis (ALS, also known as Lou Gehrig’s disease).

It’s important to understand that Medicare does not automatically notify you when it’s time to enroll—especially critical for those living outside the United States.

If you’re already receiving Social Security or Railroad Retirement Board benefits, you’ll be automatically enrolled in Medicare Parts A and B at age 65. Your Medicare card typically arrives 1–2 months before your 65th birthday. The same applies to individuals who qualify early due to a disability. However, if you live in Puerto Rico, you must actively apply for Part B—even if you’re already receiving Social Security benefits.

If you haven’t started collecting retirement benefits yet, you’ll need to submit a Medicare application yourself. The government expects you to know your enrollment window and take action accordingly.

Next, we’ll look at the specific timing and steps to enroll in Medicare.

Initial Enrollment Period

The Initial Enrollment Period (IEP) for Medicare Parts A, B, and D spans 7 months, commencing 3 months prior to your 65th birthday month and extending for 3 months after your birth month. Enrolling in Medicare within this timeframe ensures no late penalties and eliminates pre-existing condition waiting periods.

The timing for enrolling in Medicare Parts A, B, and D hinges on whether Medicare is intended to be your primary coverage or if you still have employer coverage.

Applying for Medicare as Your Main Coverage

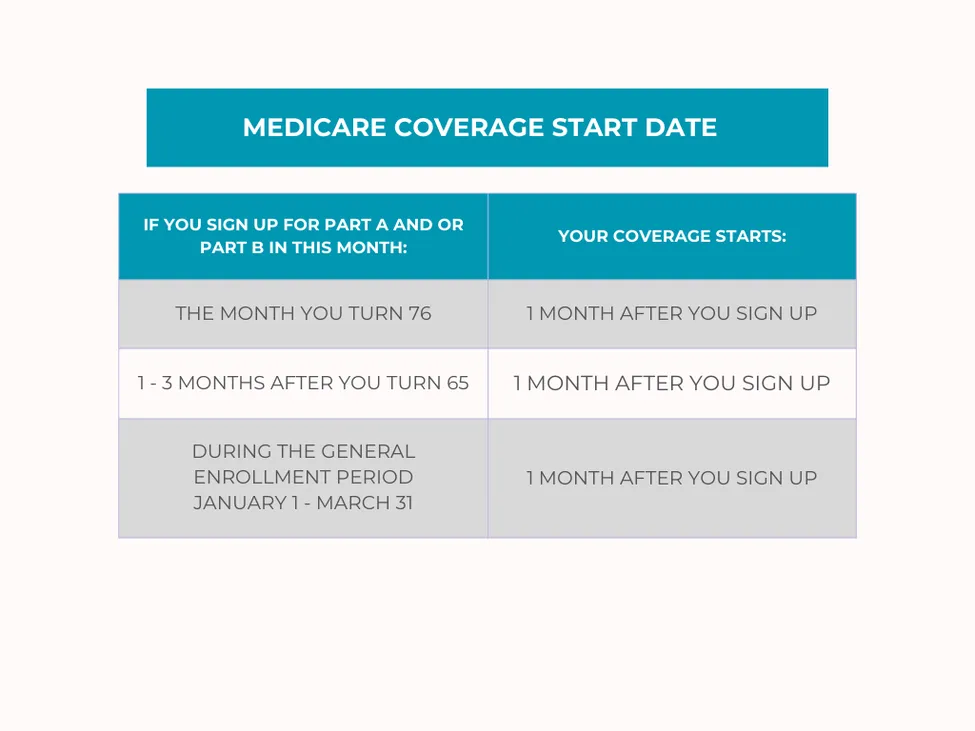

If Medicare will be your primary coverage, it’s best to enroll during the three months before your 65th birthday month. Doing so ensures your benefits begin on the first day of your birthday month.

If you enroll during your birth month or within the three months following it, your Medicare coverage will start on the first day of the month after you apply.

If you’re leaving employer coverage during your Initial Enrollment Period (IEP), your IEP takes priority over other enrollment windows. Many people mistakenly believe their Medicare will begin as soon as their group coverage ends—but that’s not always the case.

The timing of your application directly affects when your coverage begins, making it essential to understand these deadlines. If your birthday month has already passed and you’re still within your IEP, expect a delay before your Medicare coverage starts.

Enrolling before your 65th birthday month is usually the most beneficial option—but ultimately, the decision is yours.

Enrolling During the General Enrollment Period

If you don’t have other qualifying health coverage and fail to enroll during your 7-month Initial Enrollment Period (IEP), you may be subject to a Part B late enrollment penalty—equal to 10% for every full 12-month period you went without coverage.

In this situation, you’d have to wait for the General Enrollment Period, which runs from January 1 to March 31 each year. Your Part A and Part B coverage would then begin on the first day of the month following your enrollment.

This delay could leave you temporarily uninsured for hospital and medical services, potentially leading to significant out-of-pocket expenses.

Enrollment in Medicare and Coverage with Small Employers

If you are covered by a small employer (fewer than 20 employees), it is advisable to enroll in both parts of Medicare during your IEP. In cases where the employer has fewer than 20 employees, Medicare takes precedence as the primary coverage. Therefore, providing your doctors with your Medicare card first is crucial. Enrolling in Medicare at age 65 is highly significant, especially when employed by a small business.

Enrolling in Medicare with Large Employer Coverage

Medicare can coordinate with your employer-sponsored health insurance—even if you or your spouse are still actively working. If either of you is employed by a company with 20 or more employees and covered under that employer’s group health plan, Medicare acts as secondary coverage.

In this case, you have the option to enroll in Medicare Part B or delay it without penalty. Many people choose to postpone Part B enrollment while still covered under a group health plan to avoid paying unnecessary premiums, especially if the employer coverage already includes comprehensive medical benefits.

The right time to enroll in Medicare depends on your unique situation. However, it’s important to be aware that Social Security representatives may occasionally misinterpret the coordination rules, which can cause enrollment issues. That’s why it’s wise to consult with a knowledgeable Medicare broker like Senior Solutions. We’ve helped countless clients resolve Medicare complications through clear communication and direct coordination with Social Security.

If you’re still working at age 65, we’ll help compare your employer coverage costs against Medicare to determine the most cost-effective option. Based on your circumstances, we’ll guide you on whether to enroll in Part A, Part B, or both.

Additionally, if you choose to delay Medicare due to having creditable employer coverage, you’ll qualify for a Special Enrollment Period (SEP) when that coverage ends. To apply during an SEP, you must submit CMS Form 40B (to request Part B) and CMS Form L564 (to verify your employer coverage). Keep in mind that approval through a SEP can take a few weeks, so it’s important to plan ahead.

How to Enroll in Medicare

There are multiple methods available for applying for Medicare, allowing you to choose the option that suits your schedule best. Keep in mind that, as Medicare provides individual coverage, you will need to complete your own application.

The process of applying for Medicare online

Social Security provides a convenient online application for Medicare that can be completed in less than ten minutes, even if you are not currently receiving income benefits. Simply go to the Social Security website, create an account, and navigate to the application links for Medicare.

For those applying for both Social Security retirement benefits and Medicare simultaneously, use the following link: https://www.ssa.gov/retire

If you're applying for Medicare alone, visit this link: https://www.ssa.gov/benefits/medicare/

While waiting for Social Security to process your request, our helpful agents can guide you through Medicare Supplement insurance options, ensuring your coverage is prepared. While enrolling online is the most straightforward, some individuals encounter issues due to incorrect data in the Social Security system. In such cases, signing up by phone is an alternative worth considering.

Applying for Medicare By Phone

Applying for Medicare by phone is a straightforward process, comparable to the online application. Contact Social Security at 1-800-772-1213 (or for TTY users, dial 1-800-325-0778) and inform the representative of your intention to apply for Medicare. For individuals with Railroad Retirement, reaching out to the U.S. Railroad Retirement Board at 1-877-772-5772 is an alternative. While immediate assistance is possible, during peak call times, Social Security may schedule a telephone appointment to guide you through the application process.

Your Social Security representative may send you forms to complete, which are typically uncomplicated. It's important to note that phone applications for Medicare may take longer, as the forms need to be mailed to you, completed, and then returned by mail. Therefore, consider the phone enrollment option only if you have a month or two lead time before your intended Medicare effective date to avoid potential delays.

Applying for Medicare in Person

Some individuals opt for an in-person Medicare application at a local Social Security office, especially if their 65th birthday is approaching rapidly and they need prompt processing. To find the closest office in your state, you can check the Social Security website. During your meeting with a representative, request a printout confirming your application for Medicare Part A & B. This document will provide the necessary details for progressing with your Medicare Supplement application and/or Part D prescription drug plan.

Feel free to inquire about various aspects, such as your Medicare expenses, eligibility for premium-free Part A, Income Related Monthly Adjustment Amount (IRMAA) surcharges, and payment alternatives. For instance, if you are not yet receiving Social Security benefits, you can choose to pay a quarterly bill directly or opt for monthly online payments.

Frequent Questions About Applying for Medicare

What is Medicare?

Medicare is a nationwide health insurance initiative that delivers hospital and medical coverage through two distinct segments. Part A of Medicare encompasses inpatient hospital care, hospice services, skilled nursing facility care, home health care, and additional benefits. On the other hand, Part B covers outpatient services like doctor visits, surgeries, durable medical equipment, and more. It's important to note that Medicare does not cover the entire cost of these services.

When can I expect to receive my Original Medicare card?

In most cases, you’ll receive your Medicare card about three weeks after submitting your application.

If you’re already receiving Social Security benefits at age 65, your card will be mailed to you approximately two months before your 65th birthday.

Once you receive your card, be sure to review your options for Part D prescription drug coverage and enroll before your Initial Enrollment Period (IEP) ends to avoid any late penalties or gaps in coverage.

Is Medicare automatically granted when I reach the age of 65?

Perhaps! If you are already receiving Social Security benefits at least four months before your 65th birthday month, you will be automatically enrolled in Medicare at the age of 65. Otherwise, you will need to personally enroll in Medicare.

When does the Medicare open enrollment period occur?

The Medicare enrollment period aligns with your birthday, spanning seven months and starting three months before your 65th birthday month. To prevent penalties, ensure you register for Medicare during this window. It's important not to mix up this enrollment period with the Annual Election Period (AEP) in the fall.

Do I apply for Medicare yearly?

The good news? You don’t need to reapply every year—one Medicare application is all it takes.

Once enrolled, your Medicare Part A and Part B coverage will automatically renew each year, as long as you continue paying any required premiums. Part D prescription drug plans also renew annually; however, their benefits, premiums, and formularies can change. That’s why it’s essential to review your plan each fall during the Annual Election Period (AEP).

While applying for Medicare is a key first step, it’s important to understand that Original Medicare doesn’t cover all healthcare costs. You’ll still be responsible for deductibles, coinsurance, and other out-of-pocket expenses—making it wise to consider additional coverage to help protect yourself financially.

Applying for Medicare with our FREE assistance

Still feeling unsure about the Medicare application process?

Not confident navigating it on your own or unclear about your enrollment timeline?

You don’t have to go through it alone—we’re here to help every step of the way.

If Medicare will be your primary coverage and you’d like a personal guide to walk you through the entire process—from your initial application to setting up your Medigap and Part D plans—Senior Solutions is your trusted resource. Our support is completely free of charge, and once you’re enrolled, you’ll have ongoing access to our Client Service Team for continued assistance throughout the life of your policy.

Get expert help and peace of mind—contact Tessa Crider Insurance today to explore your Medicare options with confidence.

Key Takeaways

You have three distinct enrollment periods available to apply for Medicare: the Initial Enrollment Period, a Special Enrollment Period, and the General Enrollment Period.

Should you maintain creditable employer insurance beyond the age of 65, you can postpone Medicare enrollment and become eligible for a Special Enrollment Period.

If automatic enrollment in Medicare doesn't apply to you, and you need to initiate the application process, you have the option to do so via phone, online, or in person at the Social Security office.

Tessa Crider Insurance - Get FREE Assistance

If Medicare feels confusing, you don’t have to figure it out alone. Our friendly, knowledgeable agents are here to guide you every step of the way—making the process simple and stress-free.

We start with the basics, helping you understand your Original Medicare coverage. This foundation is key to finding the supplemental plan that fits your needs, especially if you’re new to Medicare.

Once your policy is in place, you’ll have peace of mind knowing we’re just a phone call away whenever you need help or have questions.

Best of all—our services are completely free. Experience the difference of having Tessa Crider Insurance on your side. Call (386) 288-2753 or click the button below to get started: