Medicare Eligibility

Key Points

Your eligibility for Medicare is not dependent on reaching Full Retirement Age or qualifying for Social Security benefits.

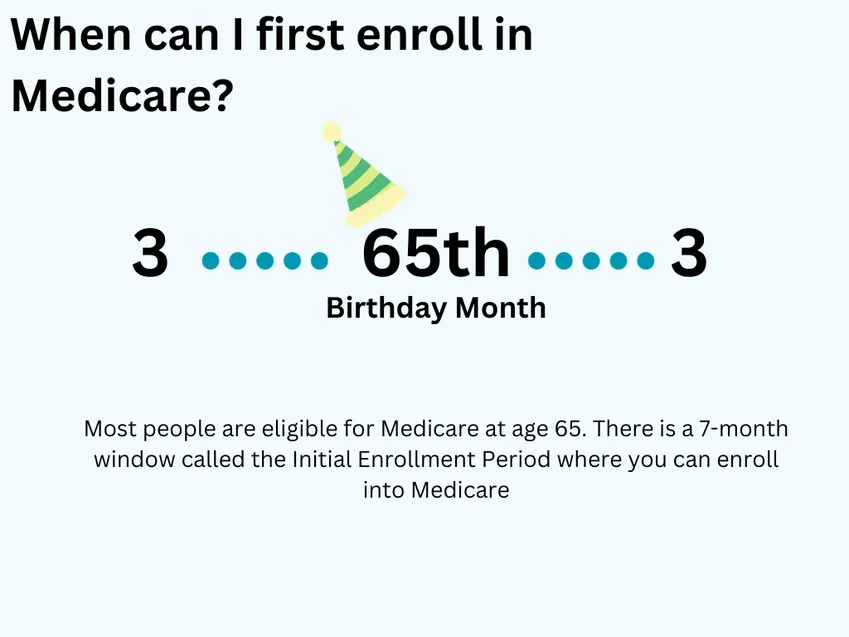

Most people become eligible for Medicare at age 65 and enroll during their 7-month Initial Enrollment Period (IEP), which begins three months before their birthday month and ends three months after.

However, some individuals may qualify for Medicare before age 65 if they are receiving Social Security Disability Insurance (SSDI) or have certain medical conditions, such as End-Stage Renal Disease (ESRD) or ALS (Lou Gehrig’s disease).

We'll Find The Right Plan for YOU for FREE

We understand Medicare, so you don't have to

Who qualifies for Medicare, and when does coverage begin?

Most individuals become eligible for Medicare at age 65. Additionally, those who have received Social Security Disability Insurance (SSDI) for at least 24 months also qualify, regardless of age.

It’s important to understand that Medicare eligibility is separate from Social Security retirement age. While full retirement benefits typically begin around age 67, that age does not determine when you qualify for Medicare.

Unlike Social Security, Medicare does not have a “retirement age.” The standard eligibility age is 65, regardless of whether you’re still working or have retired. U.S. citizens and legal permanent residents who have lived in the U.S. continuously for five years or more are generally eligible for Medicare at age 65 or older.

You may also meet Medicare eligibility criteria if you are under the age of 65 in the following situations:

1. Permanently disabled and have been receiving Social Security disability income benefits for 24 months.

2. Diagnosed with end-stage renal disease, indicating kidney failure necessitating dialysis or awaiting a kidney transplant.

3. Affected by Amyotrophic Lateral Sclerosis (ALS), commonly known as Lou Gehrig's disease.

Continue reading for more in-depth information on Medicare eligibility.

Qualification for Medicare Part A

You become eligible for Medicare Part A at age 65 if you or your spouse has legally worked in the U.S. for at least 10 years (40 quarters). During those working years, payroll taxes were contributed toward your future Medicare hospital benefits so most Americans qualify for premium-free Part A, which primarily covers inpatient hospital stays.

If you haven’t met the 10-year work requirement, you can still purchase Part A. The standard premium is $505 per month, though individuals who’ve worked 30–39 quarters may qualify for a reduced rate. For exact pricing and eligibility, it’s best to contact Social Security directly.

If you’re already receiving Social Security income benefits by the time you turn 65, you’ll be automatically enrolled in both Part A and Part B. In that case, your Medicare card should arrive by mail approximately 4 to 6 weeks before your 65th birthday.

Medicare Part B Eligibility

You become eligible for Medicare Part B at age 65, or earlier if you meet specific criteria. If you’re already receiving Social Security or Railroad Retirement Board benefits when you turn 65, you’ll be automatically enrolled in Part B. In that case, your Medicare card will typically arrive about three months before your 65th birthday.

If you’re not yet receiving Social Security or Railroad Retirement benefits, you’ll need to manually enroll in Part B during your Initial Enrollment Period (IEP). This 7-month window begins three months before the month you turn 65 and ends three months after.

Missing your IEP could result in late enrollment penalties and potential gaps in coverage, so it’s important to enroll on time.

Medicare Part C Eligibility

Medicare Advantage, also known as Medicare Part C, allows you to receive your Medicare benefits through a private insurance company instead of through Original Medicare. These plans often feature smaller provider networks, and many include built-in Part D prescription drug coverage for added convenience.

To be eligible for a Medicare Advantage plan, you must be enrolled in both Medicare Part A and Part B and live within the plan’s service area.

It’s important to understand that enrolling in a Part C plan does not eliminate your responsibility for Part B premiums. You must maintain active enrollment in both Parts A and B for as long as you’re enrolled in either a Medicare Advantage or Medigap plan.

Medicare Part D Eligibility

You qualify for Medicare Part D as long as you are currently enrolled in either Part A and/or Part B and reside within the service area of the Part D plans. While Medicare Part D is an optional program, we highly recommend considering it if you lack alternative drug coverage. Part D serves as insurance against potential high medication costs in the future and can also offer reduced copays on your current medications.

It's essential to note that failure to enroll in Part D, without having other creditable coverage, may result in late penalties when you decide to enroll later.

Frequently Asked Questions

While Medicare was originally designed for individuals aged 65 and older, eligibility has expanded over time. Today, the following groups may also qualify for Medicare under specific conditions:

1. Individuals receiving Social Security Disability Insurance (SSDI) are automatically enrolled in Medicare after 24 months of disability benefits.

2. Those diagnosed with ALS (Lou Gehrig’s disease) and receiving SSDI are enrolled in Medicare immediately, starting from the first month of benefits.

3. Individuals with End-Stage Renal Disease (ESRD)—including those undergoing dialysis or who have had a kidney transplant—may also qualify for Medicare. Coverage begins based on the timing and nature of their treatment.

Can anyone get Medicare?

No, eligibility for Medicare is restricted to U.S. citizens or permanent residents who have maintained continuous residency in the United States for at least 5 years.

When am I eligible for Medicare?

If you are entering the Medicare program, eligibility begins at age 65, irrespective of your application status for Social Security income benefits.

Can someone get Medicare at age 62?

No, unless they meet specific qualifying circumstances mentioned in the previous question. The eligibility date for Medicare is distinct from your Social Security eligibility date.

What age can you apply for Medicare?

You have the option to apply as early as age 64, starting from 3 months before your 65th birthday month.

How many years do you need to work for Medicare eligibility?

Eligibility for Medicare is not contingent on your work history. Nevertheless, individuals who have contributed to Medicare payroll taxes for a minimum of 10 years (40 quarters) will receive Part A services without incurring premiums once they become eligible.

Do I have to sign up for Medicare at 65?

No, you’re not required to enroll in Medicare at age 65—but delaying enrollment without having other creditable health coverage can lead to penalties.

It’s also important to understand that when you begin receiving Social Security income benefits, you are automatically enrolled in Medicare Part A, as the two programs are closely linked.

Who is eligible for Medicaid and Medicare?

Medicare is the national health insurance system for individuals aged 65 and older and those with specific disabilities. Medicaid, on the other hand, is a collaborative federal and state program designed to offer benefits to individuals with low incomes.

It is feasible to be eligible for both Medicare and Medicaid, with Medicare serving as the primary coverage and Medicaid as secondary.

If I've never worked, Can I get Medicare?

Certainly, eligibility for Medicare is granted to U.S. citizens or permanent residents with at least 5 continuous years of residency. Notably, if you haven't worked in the U.S., Medicare costs may be higher, entailing payment of the Medicare Part A premium. An exemption from Part A premiums is possible if your spouse has a qualifying work history.

Key Takeaways

Yes, if you have other creditable coverage, such as a qualified employer-sponsored health plan, you can choose to delay Medicare enrollment beyond age 65 without penalty.

However, if you miss your Initial Enrollment Period and do not have creditable coverage, you may be subject to late enrollment penalties.

For personalized guidance on the best time to enroll in Medicare, feel free to contact our team at (386) 288-2753. Our assistance is completely free.

Tessa Crider Insurance - Get FREE Assistance

If Medicare feels confusing, you don’t have to figure it out alone. Our friendly, knowledgeable agents are here to guide you every step of the way—making the process simple and stress-free.

We start with the basics, helping you understand your Original Medicare coverage. This foundation is key to finding the supplemental plan that fits your needs, especially if you’re new to Medicare.

Once your policy is in place, you’ll have peace of mind knowing we’re just a phone call away whenever you need help or have questions.

Best of all—our services are completely free. Experience the difference of having Tessa Crider Insurance on your side. Call (386) 288-2753 or click the button below to get started: